by GS Early

by GS Early

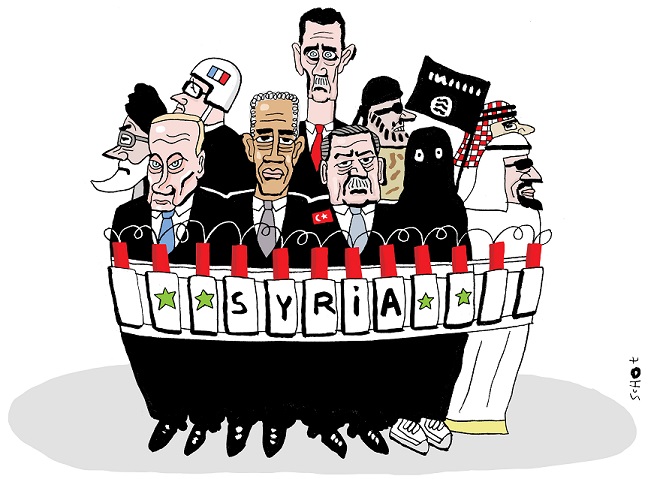

What does it say about the mass media when massive forces from Saudi

Arabia, Morocco, Bahrain, Qatar, UAE, Turkey and Egypt are sitting in

Turkey along the Syrian border ready to invade, and it’s not front page

news?

It’s likely that most of the mainstream media thinks the

U.S. can hold the reins on this Saudi-led coalition of Sunni Muslim

nations. The problem is, there’s a lot of unrest in the House of Saud

right now, and it’s already fighting (poorly) a war against Shia Muslims

in Yemen, on its southern border.

Saudi Arabia is also running

the train on global oil prices, trying to drive higher cost U.S.

producers into submission and destabilize Russia at the same time. It’s

actually likely the U.S. is at least a silent partner in the Saudi move

since low oil prices hurt Russia more than the U.S. and also hurt Iran,

since Iran’s oil exports have now come back online after years of

embargo. Low prices keep the Iranians in check.

But the problem is that the biggest victim of the low oil prices at

this point may well be Saudi Arabia itself. Since it has very little

diversity in its economy, if oil is cheap the Kingdom doesn’t have the

cash to throw around.

Also bear in mind that the royal family

isn’t a benevolent monarchy of Sunnis. There are many restive elements,

from Shias to foreign workers to more fundamental and liberal religious

movements. And a bad economy brings all these elements to the surface.

As

we in the U.S. know all too well, if your economy is in the dumps, one

of the best solutions is a big war in a small country where you clamp

down hard on domestic agitators under a “national security” cloak

without drawing much attention. This is very tempting to Saudi leaders.

Saudi Arabia is also angry about the new U.S. nuclear treaty with

Iran, since the fundamentalist Sunnis do not like the conservative

Shias. Saudi Arabia sees Syria as a way to show it can be a regional

leader and go after Syria’s leadership. It is itching for a fight.

And the U.S. probably likes the idea of this coalition doing the dirty work. Muslims fighting Muslims.

However,

there are some serious issues here since Turkey is more interested in

controlling its nemesis, the Kurds, in Syria (while no one is looking).

And the Saudis are actually kindred spirits of ISIS. They are both

fundamentalist Sunnis and it’s very likely that the Saudis are

supporting them, like Iran supports Hezbollah (which is fighting in

Syria with the Russians for the Syrian government).

But if they cross that border, then Turkey, a NATO ally, is now

engaged in a hot war with Syria, Iran and Russia directly. That’s a

weird place to be for NATO, since they would technically have to support

Turkey.

Also, these forces are not the best equipped to be

marching on the battle tested forces that are in Syria right now. The

Saudis are having a hard time bringing a breakaway Shia group in Yemen

to heel. Simply put, they’re not ready for prime time. It would be a

massive embarrassment internationally if this coalition got sent

packing.

But the biggest issue is the fact that if the Keystone

Cops Coalition stumbles into Syria, it could well have serious blowback

in Saudi Arabia, Europe and the U.S. And might start WW III.

If

the Saudis go into Syria to settle the score with Iran, there’s a good

chance the Kingdom may suffer. Remember, wars are very expensive and

when your economy is doing poorly, it will gut the national resources.

And those restive forces are ready to pounce.

If Saudi Arabia begins to implode, the U.S. will have to step in, as

will Iran and the Russians. It would likely be a fire that would light

up the entire Middle East.

What does all this mean for you? It

means you need to check Personal Liberty Digest™ and other alternative

media that will actually tell you this is going on, and if this force

does move, oil will soar because the risk premium will go from 0 to 100

in nanoseconds. The

United States Oil ETF (USO) or for the risk takers the

Velocity Shares 3x Long Crude Oil ETN (UWTI) are a good way to jump in on the rally. USO focuses on U.S. oil production. U.S. producers would revel from a Saudi collapse.

It

will also be a boon for gold and the U.S. dollar, which will be a safe

port in the storm. But in the end, it’s likely it will spell the end of

the U.S. dollar as the world’s reserve currency (basically that means,

since every commodity is priced in U.S. dollars, every nation that needs

commodities has to have U.S. dollars). That fight for primacy means

gold wins again.

Ben Shapiro

Ben Shapiro Jeff B/DDHQ

Jeff B/DDHQ

![BREAKING: SHOCK Hillary Email JUST DISCOVERED Giving Information To Terrorists How To Kill Ambassador Stevens [Read Full Story Here]](http://rightalerts.com/wp-content/uploads/2016/03/hillary-chris-stevens-320x181-300x170.jpg)