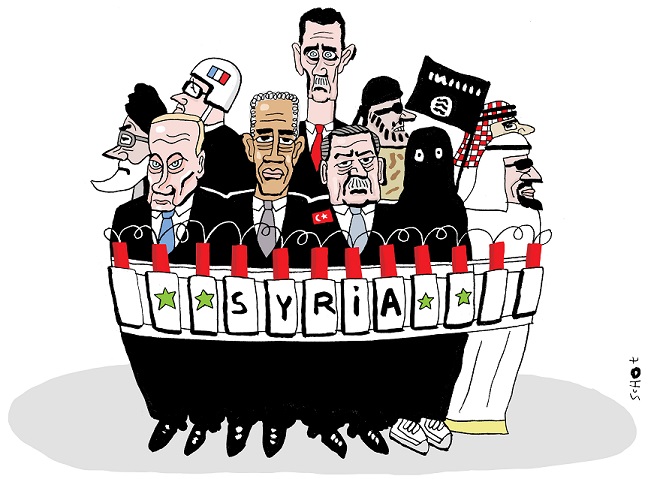

What does it say about the mass media when massive forces from Saudi Arabia, Morocco, Bahrain, Qatar, UAE, Turkey and Egypt are sitting in Turkey along the Syrian border ready to invade, and it’s not front page news?

It’s likely that most of the mainstream media thinks the U.S. can hold the reins on this Saudi-led coalition of Sunni Muslim nations. The problem is, there’s a lot of unrest in the House of Saud right now, and it’s already fighting (poorly) a war against Shia Muslims in Yemen, on its southern border.

Saudi Arabia is also running the train on global oil prices, trying to drive higher cost U.S. producers into submission and destabilize Russia at the same time. It’s actually likely the U.S. is at least a silent partner in the Saudi move since low oil prices hurt Russia more than the U.S. and also hurt Iran, since Iran’s oil exports have now come back online after years of embargo. Low prices keep the Iranians in check.

But the problem is that the biggest victim of the low oil prices at this point may well be Saudi Arabia itself. Since it has very little diversity in its economy, if oil is cheap the Kingdom doesn’t have the cash to throw around.

Also bear in mind that the royal family isn’t a benevolent monarchy of Sunnis. There are many restive elements, from Shias to foreign workers to more fundamental and liberal religious movements. And a bad economy brings all these elements to the surface.

As we in the U.S. know all too well, if your economy is in the dumps, one of the best solutions is a big war in a small country where you clamp down hard on domestic agitators under a “national security” cloak without drawing much attention. This is very tempting to Saudi leaders.

Saudi Arabia is also angry about the new U.S. nuclear treaty with Iran, since the fundamentalist Sunnis do not like the conservative Shias. Saudi Arabia sees Syria as a way to show it can be a regional leader and go after Syria’s leadership. It is itching for a fight.

And the U.S. probably likes the idea of this coalition doing the dirty work. Muslims fighting Muslims.

However, there are some serious issues here since Turkey is more interested in controlling its nemesis, the Kurds, in Syria (while no one is looking). And the Saudis are actually kindred spirits of ISIS. They are both fundamentalist Sunnis and it’s very likely that the Saudis are supporting them, like Iran supports Hezbollah (which is fighting in Syria with the Russians for the Syrian government).

But if they cross that border, then Turkey, a NATO ally, is now engaged in a hot war with Syria, Iran and Russia directly. That’s a weird place to be for NATO, since they would technically have to support Turkey.

Also, these forces are not the best equipped to be marching on the battle tested forces that are in Syria right now. The Saudis are having a hard time bringing a breakaway Shia group in Yemen to heel. Simply put, they’re not ready for prime time. It would be a massive embarrassment internationally if this coalition got sent packing.

But the biggest issue is the fact that if the Keystone Cops Coalition stumbles into Syria, it could well have serious blowback in Saudi Arabia, Europe and the U.S. And might start WW III.

If the Saudis go into Syria to settle the score with Iran, there’s a good chance the Kingdom may suffer. Remember, wars are very expensive and when your economy is doing poorly, it will gut the national resources. And those restive forces are ready to pounce.

If Saudi Arabia begins to implode, the U.S. will have to step in, as will Iran and the Russians. It would likely be a fire that would light up the entire Middle East.

What does all this mean for you? It means you need to check Personal Liberty Digest™ and other alternative media that will actually tell you this is going on, and if this force does move, oil will soar because the risk premium will go from 0 to 100 in nanoseconds. The United States Oil ETF (USO) or for the risk takers the Velocity Shares 3x Long Crude Oil ETN (UWTI) are a good way to jump in on the rally. USO focuses on U.S. oil production. U.S. producers would revel from a Saudi collapse.

It will also be a boon for gold and the U.S. dollar, which will be a safe port in the storm. But in the end, it’s likely it will spell the end of the U.S. dollar as the world’s reserve currency (basically that means, since every commodity is priced in U.S. dollars, every nation that needs commodities has to have U.S. dollars). That fight for primacy means gold wins again.

No comments:

Post a Comment